In recent years, digital lending has changed how people access credit in Kenya, offering quick financial solutions.

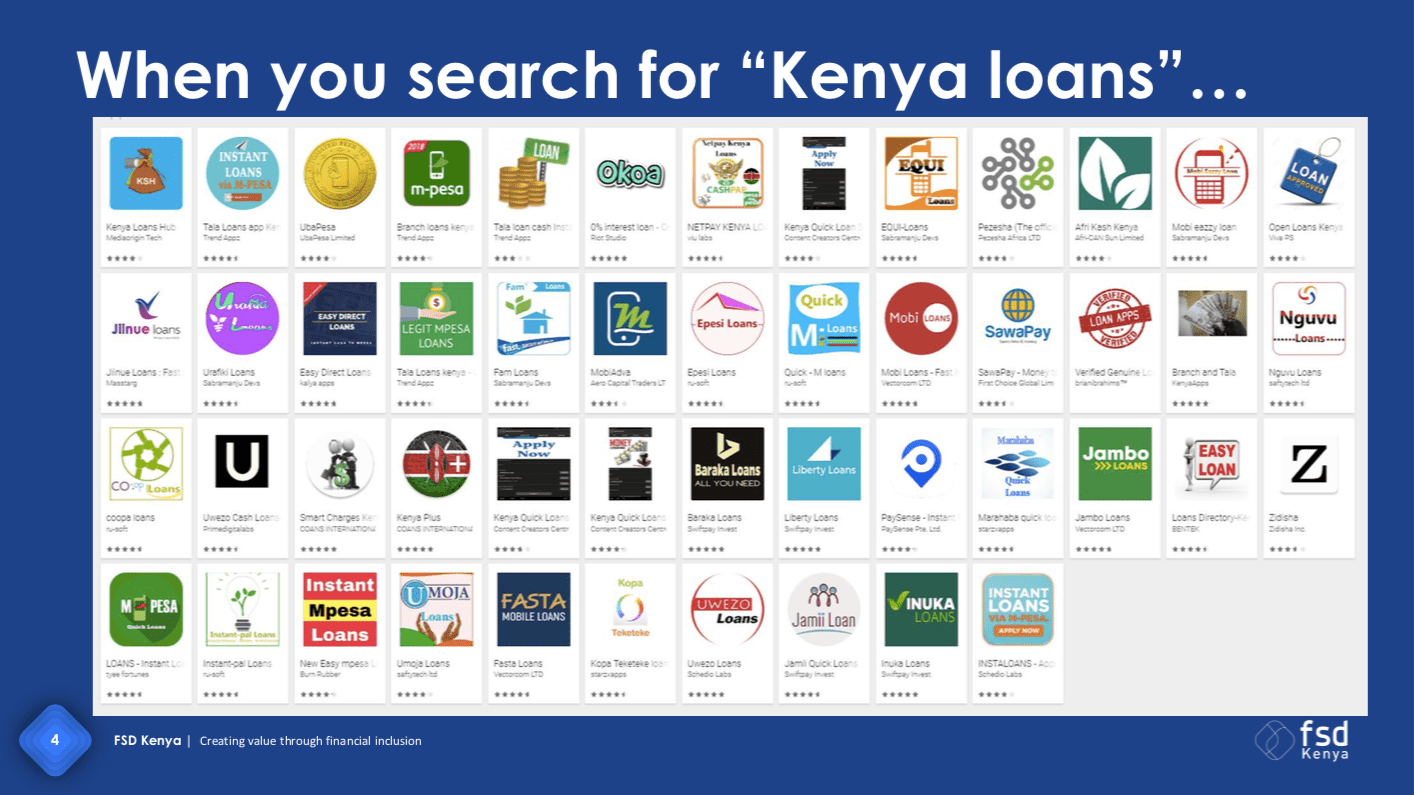

However, this growth has also led to a rise in fake loan applications and predatory lending practices.

Many borrowers fall victim to fraudulent loan apps that promise fast cash but end up trapping them in high-interest debt with hidden fees.

This article will highlight the warning signs of fake loan apps in Kenya, how to spot legitimate lenders, and tips to protect yourself from financial scams in the digital lending world

Fake Loan Apps In Kenya

In the bustling world of digital lending, access to credit has never been easier for Kenyans seeking rapid financial solutions.

With just a few taps on a smartphone, loans can be secured in an instant, offering a lifeline to those in need.

But beware! This convenience comes with a dark side as a wave of fake loan applications and predatory lending practices threatens to ensnare unsuspecting borrowers

. Promising instant cash, these fraudulent apps often lead users into a vicious cycle of debt, complete with sky-high interest rates and hidden fees.

In this article, we’ll expose the warning signs of these scams, show you how to spot genuine lenders, and arm you with essential tips to safeguard your finances in this treacherous digital landscape.

Growing Concern

Kenya’s financial landscape has changed a lot in recent years, mainly due to technology. Mobile banking and digital lending platforms now offer easy access to loans.

However, this growth has also brought a rise in fake loan apps that exploit desperate borrowers.

These fake apps take advantage of vulnerable individuals and cause financial harm, often leaving people in debt.

It’s important for consumers to understand how these fraudulent apps work, the lack of regulation, and the precautions they need to take when seeking financial help.

Dubious Constitutions and Rip Off Schemes

Fake loan apps often appear as legitimate financial institutions, using flashy marketing and professional websites to attract customers.

However, upon closer inspection, many lack a proper legal structure.

They usually don’t have a physical address, customer service, or clear business practices, making it hard for consumers to seek help if they fall victim to fraud.

Fake loan apps often use pressure tactics to make borrowers accept loans quickly, discouraging them from reading the fine print or asking questions.

They create a sense of urgency that leads to hasty decisions.

These apps also ask for too much personal information, which they may sell or misuse.

This can lead to identity theft or harassment by debt collectors if repayments are missed.

While legitimate lenders are transparent about interest rates, fake loan apps hide their high charges in fine print or misleading marketing.

Borrowers may initially think they’re getting a good deal, only to face hidden fees that make repayment much more expensive.

Registration and Licensing

Most fake loan apps operate without proper registration or licensing from the Central Bank of Kenya (CBK) or the Kenya Financial Regulatory Authority.

Legitimate lenders must follow strict rules to protect consumers, but many fraudulent apps ignore these requirements.

Without oversight, these apps can operate freely and engage in dishonest practices. That’s why it’s important for customers to carefully check any loan service before signing up.

Due Diligence for Customers

Research the Lender: Look up the lender’s name on the CBK website or check online reviews. Trusted institutions will have an online presence and be known in the community.

Verify Licensing: Ensure the lender is registered with the CBK or other relevant bodies. You can find this information on their website or confirm it by contacting them directly.

Read the Fine Print: Always read the loan agreement carefully. Understand the terms, including interest rates, repayment schedules, and any fees.

Seek Recommendations: Ask friends or family for recommendations on safe lending platforms.

Be Wary of Upfront Fees: Avoid apps that ask for payment before granting a loan. Legitimate lenders usually deduct fees from the loan amount

Negative Impact On Customers and Community

Fake loan apps use predatory practices that leave many borrowers in serious financial trouble. High interest rates and hidden fees trap borrowers in a cycle of debt, making it hard to repay loans.

As a result, people who were once financially stable may lose their savings, property, and reputations. This also harms the community, as more people in debt may struggle to contribute to the economy.

Government Regulations and Penalties

The Kenyan government has started implementing regulations to tackle the problem of fake loan apps.

The Central Bank of Kenya now requires digital lenders to be licensed, transparent, and responsible in their lending practices.

Apps operating outside these rules face severe penalties, including fines or closure.

Additionally, public awareness campaigns are educating consumers about the risks of fake loan apps and encouraging them to report fraud.

Termination

As digital lending grows in Kenya, consumers must stay alert to fake loan apps that can harm their finances. Doing proper research is essential in this age of fast loans.

By recognizing the signs of fake loan apps and predatory lending, people can protect themselves from financial exploitation.

The Kenyan government is working to regulate the sector and punish offenders, but consumer awareness is the key to fighting these dishonest practices.

Always be cautious and do thorough research to ensure safe borrowing.